Problem

Data base and Direct Marketing are, arguably, among the most important methods for any businesses to engage their customer base. It is a form of advertising which allows business to communicate directly with their customer through various media channel.

An example of database & direct marketing is when a business need to answer some important questions, and here bellow are the question we suppose methods in this post to discover them:

- Who are the best customer, who need a reminder, who need to be upsold…?

- What kind of offer should we provide?

- Timing: When should the offer be sent out?

Many techniques have been developed to improve the effectiveness of a campaign by looking at a single or multiple factors listed above. Today, we will be introducing RFM Model, a popular technique used to analyze customer value to allow business to develop better advertising target list.

We know that customers will react to various campaigns differently, and some customers will be more likely to engage in some campaign compare to the rest.

Hence, the offer delivered to this customer group will be more effective and RFM Model provides an analytical framework to understand the business customers, segment them into various groups based on their engagement with the business and enable business to have a better mean to determine which customers should they target with their marketing campaign.

What is RFM?

RFM stands for Recency, Frequency and Monetary.

Recency is defined as the interval between the latest interaction of the customer with the business (transaction, web visit, call, etc…) with the current or specified time. Frequency is defined as the number of interaction customers have initiated within a time period and Monetary is defined as the cumulative money spent by the customer with the business in a specific time period.

A common observation people has noticed is that a customer who has

- recently made a purchase with a business

- made regular or frequent purchase with business and

- spent large amount of money for the business product will be more likely to respond positively to future marketing effort.

In RFM Model, customers are evaluated based on the three variables and then assigned a RFM score to represent their individual rating across the three categories. The higher the RFM score, the more likely the customer will response to a business engagement, be it up sale, cross sale or promotion. Clustering analysis can also be done based on customer RFM score instead of traditional variables, which will give the business a more definite view of their customer base.

So how do we go about and perform the RFM Analysis. We will first go through a simple example to explain the RFM concept, adapted from Data Mining Using RFM Analysis ( D.Bryan, 2011). Latter in an another blog we will take a more in-depth look with the actual project, in which we perform a better RFM model by some improvement in RFM scores clustering.

In order to perform RFM analysis, businesses will need to store at least three variables: Transaction Date, Transaction Amount and Customer Identifier. From these three variables input data was prepared ( as can be seen in table 1) and then RFM score will be computed. Each category will be score independently and customer categorical score will be assigned based on their performance compare to their peers for that particular category. The lowest score is 1 while the highest score given will be 5.

First, the customers will be sorted based on each category, from lowest to highest for recency while for frequency and monetary will be from highest to lowest. Then a score of 1 to 5 for each category will be assigned to the customer and then the individual score will be combined to give the customer overall RFM score. The score can be given out by giving the top 20% customer the score of 5 and then go down to 4, 3, 2, 1 for subsequent quintiles. This is the most common approach to assign the RFM score and you can see the actual score for the data in table 1 in table 2.

So with the final RFM score, it is much easier to quantify the customer. At most, there will only be 125 possible RFM score that can be assigned and for business that collect a large variety of customer data, RFM score will provide a quick, easy yet insightful point of reference to judge the customer behavior. For example, customer with RFM score of 555 (Customer 6) is clearly a regular/high net worth customer to the business while customer with the score of 155 (Customer 9) is someone the business should try to engage again as he/she used to engage with the business regularly but haven’t been seen in quite sometimes.

All in all, for each of the RFM value, a different approach can be taken in order to maximize the marketing effort. We can also apply data mining technique to RFM analysis to gain even more insight from the customer data. In reality, we use Kmeans++ clustering algorithms to split customers into 8 types, which show how they important.

(Kmeans++ algorithms with be introduced more technical in another post)

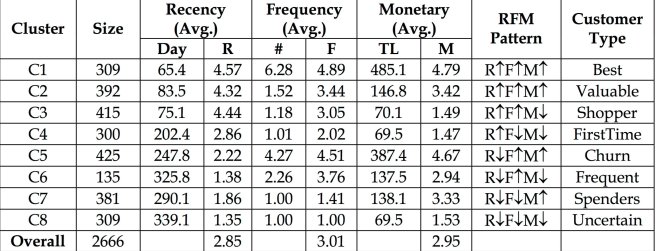

Table 3: Kmeans++ clustering on customer RFM Value.

As can be seen from Table 3, when cluster analysis was performed on customer RFM value, defined clusters can be obtained. In this example, customer RFM values were evaluated with the population average and upper arrow or lower arrow was assigned depending on whether the value is above or below average. 8 Clusters were selected because there can be 8 ( 2 x 2 x 2) possible combinations of RFM category.

We can see that with this approach, more meaningful observation and type can be assigned to the customer base, for example, between C1 and C2, even though they are both valuable customers to the business as their RFM scores are both above average, Customers in C1 are more valuable to the business compare to those in C2 as they have higher RFM score. After we have assigned the categorical type to each cluster, suitable business strategy can then be tailored to individual cluster to maximize the gain. For example, Customers in C3 has high Recency and Frequency rating but low Monetary rating, meaning the business should consider ways to up sale their products to these customers to improve their value. Customer in C3 maybe new customers to the business as they have high Recency score but low Frequency and Monetary score. The specific customer type and strategies employed can vary between business.

So we have introduced the basic of RFM Model together with how it can assist with Clustering Analysis. More information can definitely be gained from the data after the two steps, for example, classification analysis to obtained rules that can be used to predict customers likely RFM score (e.g. If the customer is male, income of 5mil VND, from Ha Noi, his RFM score is likely to be 343) or Market Basket Analysis on the cluster obtained to find potential relationship between products that customer within each cluster purchase.

If you are interested in reading more about how these techniques are applied together to deliver a holistic view to business owner, please read the article Data Mining Using RFM Analysis.

P/S: This post was written with excellent help of our intern member, Minh Nguyen.

References:

- D. Birant (2011). Data Mining Using RFM Analysis http://cdn.intechopen.com/pdfs/13162.pdf

- How to use RFM analysis for customer segmentation and classification

http://www.simafore.com/blog/bid/159575/How-to-use-RFM-analysis-for-customer-segmentation-and-classification - A review of the application of RFM model

http://www.academicjournals.org/journal/AJBM/article-full-text-pdf/EB3418D18198